What Is a Funded Trading Account?

A funded trading account is an account provided by a proprietary trading firm (prop firm) that allows traders to access capital without risking their own money. Instead of funding a trading account with personal savings, traders use firm-provided funds and receive a profit split in return.

This model benefits traders who have profitable trading strategies but lack the capital to scale their positions. Forex, stocks, commodities, and crypto traders often seek these accounts to increase their earning potential while following strict risk management guidelines.

How Do Funded Trading Accounts Work?

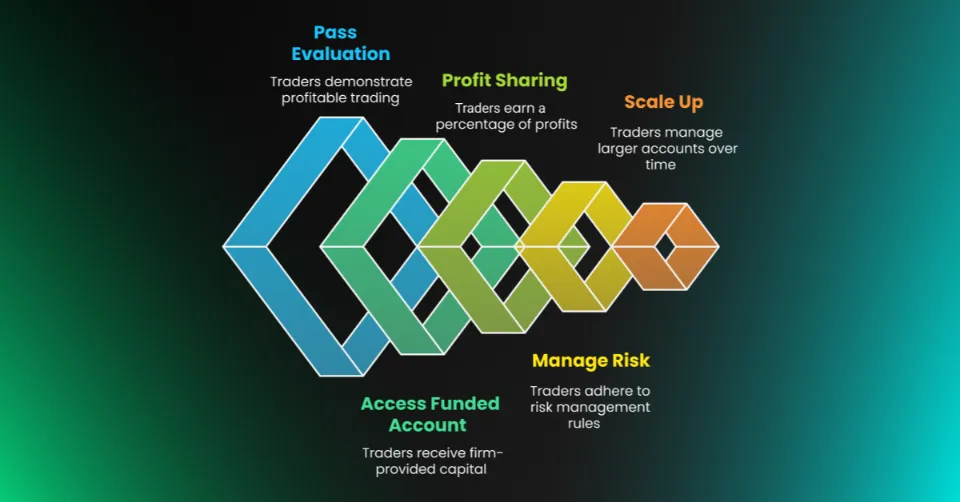

- Evaluation Process:

Traders must pass a trading challenge or evaluation to prove they can trade profitably while managing risk. - Live Funded Account:

Once a trader passes the evaluation, they receive access to a real funded account with capital provided by the firm. - Profit Sharing Model:

Traders earn a percentage of profits generated from trades, typically between 50% and 90%, depending on the firm’s payout structure. - Risk Management Rules:

Proprietary firms implement strict risk measures, including daily loss limits, maximum drawdowns, and position sizing restrictions to protect capital. - Scaling Programs:

Consistently profitable traders may be eligible for higher funding levels, allowing them to manage larger accounts over time.

Types of Funded Trading Accounts

| Type | Description | Best For |

|---|---|---|

| Evaluation-Based Accounts | Traders pass a challenge to qualify for funding. | Experienced traders with a proven strategy. |

| Instant Funding Accounts | Traders receive funding immediately without an evaluation, usually with a higher fee. | Skilled traders who want quick access to capital. |

| Profit-Split Models | Firms provide capital in exchange for a share of the profits. | Traders who prefer a shared-risk approach. |

| Scaling Accounts | Funding increases as traders meet profit targets. | Consistently profitable traders looking to scale up. |

Pros and Cons of Funded Trading Accounts

| Pros | Cons |

|---|---|

| Access to Capital: Trade with firm-provided funds. | Evaluation Fees: Some firms charge upfront fees for challenges. |

| No Personal Risk: Losses are absorbed by the firm (within limits). | Strict Rules: Traders must follow firm risk policies. |

| Higher Earning Potential: Profit splits can reach up to 90% for successful traders. | Challenge Failure Risk: Many traders struggle to pass evaluations. |

| Opportunity to Scale: Profitable traders can manage larger accounts over time. | Psychological Pressure: Trading firm capital can be stressful. |

How to Get a Funded Trading Account

To secure a funded trading account, follow these steps:

1. Choose a Prop Firm

- Research proprietary firms offering funded account programs.

- Compare profit splits, evaluation fees, and trading rules.

2. Pass an Evaluation or Trading Challenge

Most firms require traders to complete a challenge to prove their skills. Common challenge requirements include:

- Profit Target: Achieve a specific return (e.g., 8-10% within 30 days).

- Risk Management: Avoid breaching daily loss limits or maximum drawdowns.

- Consistency Requirements: Trade for a minimum number of days to demonstrate stability.

3. Trade with a Live Funded Account

Once the evaluation is passed, traders receive real capital and start trading under the firm’s guidelines.

4. Earn Profits and Scale Up

Profitable traders can:

Best Practices for Trading a Funded Account

1. Follow Risk Management Rules

- Set Stop-Loss Orders to protect against market volatility.

- Manage Position Sizes to stay within firm-imposed limits.

- Adhere to Daily Loss Limits to maintain funded status.

2. Maintain Consistency

Consistent, steady profits are more important than high-risk, high-reward trading.

3. Avoid Overtrading

Too many trades lead to unnecessary risk. Stick to a structured trading plan.

4. Use a Proven Strategy

Only trade strategies tested in live markets, avoiding random or impulsive trades.

5. Keep Learning & Adapting

Stay updated with market news, economic reports, and technical analysis to refine strategies.

Common Mistakes to Avoid in Funded Trading

- Ignoring Trading Rules: Breaking rules can result in account suspension.

- Overleveraging: Using excessive leverage increases risk.

- Lack of Patience: Many traders fail challenges by trading aggressively.

- No Trading Plan: Unstructured trading leads to inconsistent results.

Final Thoughts on Funded Trading Accounts

Funded trading accounts offer a unique opportunity for traders to access significant capital, earn profits, and scale their trading careers without personal financial risk. However, they require discipline, patience, and strong risk management skills to succeed.

To maximize your chances:

By applying these principles, traders can take full advantage of funded trading programs and achieve long-term success in the financial markets.

FAQ: Frequently Asked Questions About Funded Trading Accounts

1. What is a funded trading account?

A funded trading account is an account where a prop firm provides capital to a trader, allowing them to trade financial markets without personal risk.

2. How do I get a funded trading account?

To get funded, you must pass a trading challenge, follow risk management rules, and demonstrate consistent profitability.

3. What are the risks of trading a funded account?

Risks include losing funded status by violating firm rules, paying evaluation fees without passing the challenge, and psychological pressure from trading with external capital.

4. Can beginners apply for funded accounts?

Funded accounts are not ideal for beginners since passing a challenge requires market experience and a strong trading strategy.

5. How much can I earn with a funded account?

Earnings depend on the profit split (50% – 90%) and account size. Successful traders can make substantial profits with larger allocations.