Backtesting Forex: How to Test Your Trading Strategy Effectively

Success in forex trading isn’t just about identifying opportunities—it’s about verifying whether your trading strategy actually works before you risk real capital. That’s where backtesting forex comes in.

In this guide, we’ll explore what forex backtesting is, why it’s essential, and how you can effectively test your strategies to maximize profitability.

What Is Backtesting in Forex Trading?

Backtesting forex involves applying a trading strategy to historical market data to evaluate its effectiveness. Traders simulate past trades to determine whether a strategy would have been profitable under real market conditions.

By analyzing historical price movements, traders can refine their approach, identify strengths and weaknesses, and optimize their entry and exit points.

Why Is Forex Backtesting Important?

Backtesting is an essential part of a trader’s workflow because it:

- Validates Trading Strategies – Helps determine if a trading method is viable before using real capital.

- Improves Risk Management – Identifies potential risks and adjusts stop-loss levels accordingly.

- Optimizes Performance – Fine-tunes trading strategies by identifying what works and what doesn’t.

- Enhances Confidence – Provides traders with data-driven insights to execute trades with conviction.

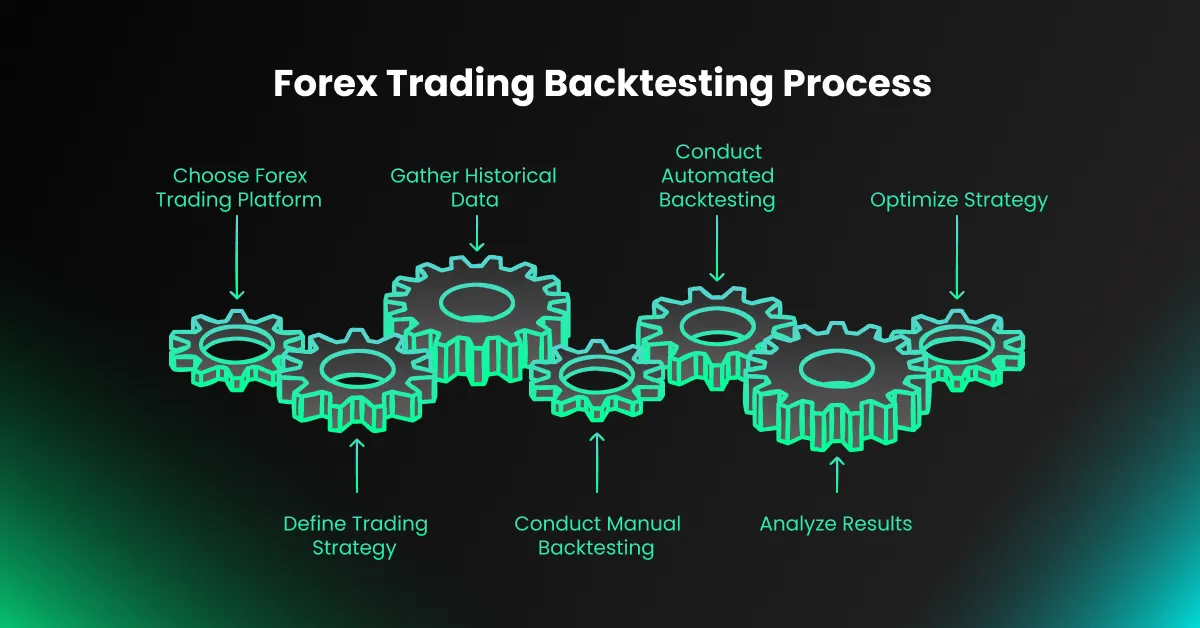

How to Backtest a Forex Trading Strategy

Step 1: Choose a Forex Trading Platform with Backtesting Tools

To conduct forex backtesting, you need a trading platform that allows for manual or automated testing. Popular platforms include:

- MetaTrader 4 (MT4) & MetaTrader 5 (MT5) – Both offer Strategy Tester for automated backtesting.

- TradingView – Provides a user-friendly charting tool with replay features.

- Forex Tester – A dedicated forex backtesting software for manual and automated testing.

Step 2: Define Your Trading Strategy

Clearly outline the rules of your strategy, including:

- Entry and exit points

- Stop-loss and take-profit levels

- Risk-reward ratio

- Trading timeframe (e.g., scalping, day trading, swing trading)

- Currency pairs to trade

Step 3: Gather Historical Data

For accurate trading strategy backtesting, use historical price data that matches your preferred timeframe. Sources include:

- Your trading platform’s built-in historical data

- Third-party providers like Dukascopy or HistData

Step 4: Conduct Manual or Automated Backtesting

Manual Backtesting

- Scroll back on a chart without seeing future price movements.

- Execute trades based on your strategy rules.

- Record results, including profit/loss, win rate, and drawdown.

Automated Backtesting

- Use backtesting software to run your strategy on past data.

- The system will execute trades automatically based on pre-set conditions.

- Analyze performance metrics such as Sharpe ratio, maximum drawdown, and return on investment (ROI).

Step 5: Analyze Results and Optimize Your Strategy

Once you’ve tested your strategy, evaluate:

- Win Rate – Percentage of successful trades.

- Risk-Reward Ratio – Profit potential vs. risk exposure.

- Drawdown – Maximum loss experienced.

- Profitability Over Time – Long-term success rate of the strategy.

If results show inconsistencies or losses, refine your strategy by adjusting:

- Stop-loss and take-profit levels

- Entry and exit rules

- Risk management parameters

Common Pitfalls to Avoid in Forex Backtesting

While forex backtesting is invaluable, traders should avoid these mistakes:

- Overfitting the Strategy – Tweaking parameters too much to fit historical data perfectly may result in failure in live markets.

- Ignoring Trading Costs – Ensure your backtest accounts for spreads, commissions, and slippage.

- Not Considering Market Conditions – Strategies should be tested in various market environments (trending, ranging, volatile).

- Lack of Sample Size – A strategy needs enough data points to validate its reliability.

Conclusion: Mastering Forex Backtesting

Backtesting forex is a crucial step in refining and validating your trading strategy. By systematically testing your approach, you can improve decision-making, optimize risk management, and enhance overall profitability.

For further learning, check out our trading tips category to take your skills to the next level!

Tools and Software for Forex Backtesting

Here are some of the best tools for trading strategy backtesting:

| Tool | Features |

|---|---|

| MetaTrader 4 & 5 | Built-in Strategy Tester for automated backtesting |

| TradingView | Chart replay for manual backtesting |

| Forex Tester | Dedicated forex backtesting software |

| Dukascopy Historical Data | High-quality forex price data for backtesting |

| Amibroker | Advanced technical analysis and backtesting |