Bullish vs Bearish Markets: Key Differences, Strategies & Trends

Financial markets constantly fluctuate between bullish and bearish phases, shaping investment strategies and economic sentiment. According to historical data, bull markets tend to last longer than bear markets, with the average bull market spanning 4.5 years, while bear markets typically last 1.3 years on average. Understanding these trends is crucial for investors looking to navigate market cycles effectively.

What Are Bullish and Bearish Markets?

A bullish market refers to a period of rising asset prices, optimism, and increased investor confidence. In such conditions, traders expect continued price appreciation, leading to higher demand for stocks, currencies, and other financial instruments.

Conversely, a bearish market is characterized by falling prices, declining investor sentiment, and reduced market participation. Investors anticipate further losses, often triggering mass sell-offs and increased market volatility. While these terms are widely used in stock markets, they also apply to forex, commodities, and cryptocurrency markets.

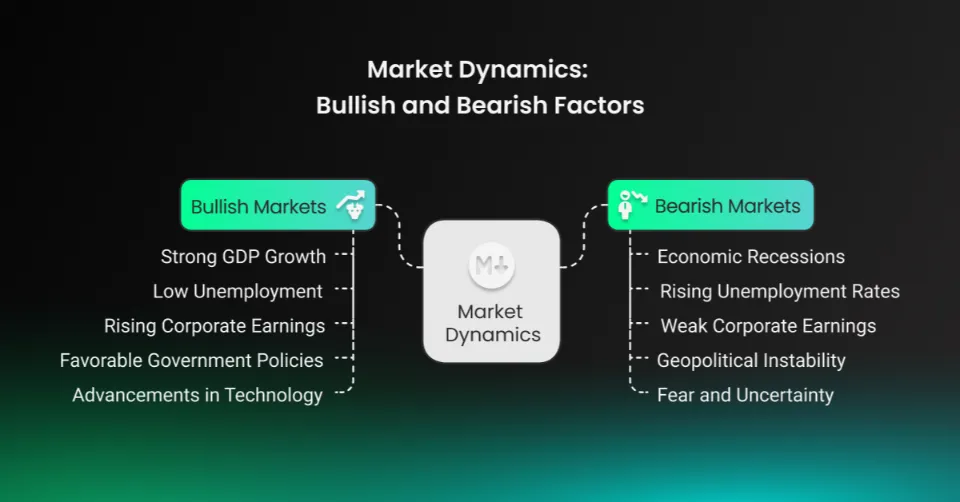

Causes of Bullish and Bearish Markets

Market trends are influenced by a combination of economic, political, and psychological factors.

Factors Driving Bullish Markets:

- Strong GDP growth and low unemployment

- Rising corporate earnings and profitability

- Favorable government policies, such as tax cuts or stimulus packages

- Advancements in technology or new industries (e.g., dot-com boom)

- High investor confidence, leading to increased buying pressure

Factors Leading to Bearish Markets:

- Economic recessions or slowdowns

- Rising unemployment rates and declining consumer spending

- Weak corporate earnings and business downturns

- Geopolitical instability, such as wars or trade conflicts

- Fear and uncertainty, leading to panic selling

Example: The 2008 Financial Crisis was a classic bearish market triggered by a housing market collapse and banking failures, leading to a global economic downturn.

Key Characteristics of Bullish and Bearish Markets

The table below summarizes the key differences between bullish and bearish markets:

| Feature | Bullish Market | Bearish Market |

|---|---|---|

| Price Trend | Rising prices | Falling prices |

| Investor Sentiment | Optimistic | Pessimistic |

| Market Volume | High buying activity | Increased selling pressure |

| Risk Appetite | High risk-taking | Low risk-taking |

| Economic Growth | Expanding economy | Contracting economy |

| Popular Assets | Stocks, commodities, growth investments | Bonds, defensive stocks, safe-haven assets |

How to Identify Bullish and Bearish Trends

Investors use technical and fundamental analysis to determine whether the market is in a bullish or bearish phase.

Technical Indicators for Trend Identification:

- Moving Averages – A rising 200-day moving average suggests a bullish trend, while a declining one signals a bearish trend.

- Relative Strength Index (RSI) – Readings above 70 indicate overbought conditions (potential bearish reversal), while readings below 30 suggest oversold conditions (potential bullish reversal).

- Trendlines & Chart Patterns – Ascending trendlines indicate bullish trends, while descending trend lines point to bearish movements.

Fundamental Indicators for Market Analysis:

- Economic Growth (GDP) – Strong GDP growth supports bullish markets, while declining GDP signals bearish conditions.

- Corporate Earnings Reports – Rising earnings drive bullish sentiment, while disappointing results fuel bearish trends.

- Interest Rates & Inflation – Lower interest rates and moderate inflation foster bullish markets, while high inflation and rising rates can trigger bearish sentiment.

Investment Strategies for Bullish and Bearish Markets

Bullish Market Strategies:

- Buy and Hold – Invest in growth stocks and hold them for long-term appreciation.

- Momentum Trading – Enter positions when stocks or currencies show strong upward trends.

- Sector Rotation – Invest in high-growth sectors like technology, consumer discretionary, and finance.

Bearish Market Strategies:

- Short Selling – Borrow assets to sell at a high price and buy back at a lower price.

- Hedging with Options – Use put options to protect against declining prices.

- Investing in Defensive Assets – Shift to safe-haven assets like gold, bonds, and dividend stocks to preserve capital.

Example: During the COVID-19 pandemic (2020), investors flocked to defensive stocks like healthcare and technology while avoiding travel and hospitality stocks.

Historical Bullish and Bearish Market Trends

Market history provides valuable lessons on the impact of bullish and bearish cycles.

| Market Event | Bullish/Bearish | Key Drivers |

|---|---|---|

| Dot-Com Boom (1995-2000) | Bullish | Tech innovation, high speculation |

| 2008 Financial Crisis | Bearish | Housing market collapse, banking failures |

| Post-COVID Rally (2020-2021) | Bullish | Stimulus measures, low interest rates |

| 2022 Bear Market | Bearish | Stimulus measures, low interest rates |

Understanding these cycles helps investors prepare for market fluctuations.

Psychological Impact on Investors

Bullish and bearish markets deeply influence investor psychology:

- Bullish Markets lead to FOMO (Fear of Missing Out), causing excessive risk-taking and speculative bubbles.

- Bearish Markets trigger panic selling, where investors exit positions out of fear rather than strategy.

Successful traders manage these emotions by sticking to well-defined strategies and risk management plans.

Short-Term vs. Long-Term Market Trends

Not all market trends are created equal—some last for years, while others occur within days or weeks.

| Trend Type | Duration | Example |

|---|---|---|

| Long-Term Trends | Several years | 2009-2020 Bull Market |

| Short-Term Trends | Weeks to months | 2022 Bear Market Rebound |

| Intraday Trends | Hours to days | News-based price movements |

| 2022 Bear Market | Bearish | Stimulus measures, low interest rates |

Economic Indicators That Influence Market Trends

Market movements are closely linked to key economic indicators, such as:

- Gross Domestic Product (GDP) – A rising GDP fuels bullish markets, while a declining GDP signals a slowdown.

- Unemployment Rate – Low unemployment is bullish; rising unemployment can trigger bearish sentiment.

- Inflation & Interest Rates – Higher inflation and rising interest rates can slow down markets, leading to bearish conditions.

Example: The Federal Reserve’s interest rate hikes in 2022 led to a bear market as investors feared slowing economic growth.

Final Thoughts on Bullish and Bearish Markets

Understanding bullish and bearish markets is essential for traders and investors aiming to navigate financial markets effectively. Key takeaways include:

✔ Bullish markets are driven by economic growth, optimism, and rising prices.

✔ Bearish markets occur due to economic downturns, pessimism, and declining prices.

✔ Identifying trends through technical and fundamental analysis is crucial for making informed decisions.

✔ Investment strategies should be tailored to market conditions—growth investing in bull markets and defensive tactics in bear markets.

By mastering these concepts, investors can better position themselves for long-term financial success, regardless of market cycles.

FAQ for Bullish vs. Bearish Markets

1. What is the difference between a bullish and bearish market?

A bullish market is characterized by rising asset prices, strong economic growth, and investor optimism, leading to increased buying activity. A bearish market occurs when asset prices decline, investor confidence weakens, and selling pressure dominates, often due to economic downturns or uncertainty.

2. How long do bullish and bearish markets last?

Bullish markets typically last longer than bearish markets. The average bull market lasts 4.5 years, while bear markets generally last 1.3 years. However, duration varies based on economic conditions and investor sentiment.

3. How do you identify a bullish or bearish trend?

Bullish trends show higher highs and higher lows, while bearish trends feature lower highs and lower lows. Technical indicators like moving averages, RSI, and trendlines help identify market direction, while economic data such as GDP growth and unemployment rates confirm trends.

4. What strategies work best in a bullish market?

In a bullish market, investors focus on buy-and-hold strategies, momentum trading, and growth investing. Sectors like technology and consumer discretionary often outperform, and leveraged positions can enhance returns.

5. What strategies work best in a bearish market?

In a bearish market, traders use short selling, hedging with put options, and investing in defensive sectors like utilities and healthcare. Safe-haven assets such as gold, bonds, and dividend stocks help protect against market downturns.

6. What causes a market to turn from bullish to bearish?

A shift from bullish to bearish can be triggered by economic slowdowns, rising interest rates, declining corporate earnings, geopolitical uncertainty, and financial crises. When investor confidence drops, selling pressure increases, leading to a market downturn.

7. Can you still make money in a bearish market?

Yes, traders and investors can profit in a bearish market through short selling, options trading, defensive stock investments, and sector rotation into less volatile assets. Hedging strategies can also minimize losses during downturns.

8. What are historical examples of bullish and bearish markets?

- Bullish Market: The Dot-com Boom (1995-2000) was a period of strong growth driven by tech stocks.

- Bearish Market: The 2008 Financial Crisis saw massive stock market declines due to the housing market collapse and banking failures.

- Mixed Market: The COVID-19 Pandemic (2020-2021) led to a sharp bear market, followed by a rapid bull recovery fueled by stimulus measures.